Today most companies feel a strong wind of digital disruptions threatening their current business models. Completely new businesses arises and rapidly captures market shares. During the last year(s) you have probably heard about several such new companies or offerings like e.g. Uber, Airbnb, Ant Financials, Klarna, Vipps, Oscar, Lemonade, Corezoid etc.

Today most companies feel a strong wind of digital disruptions threatening their current business models. Completely new businesses arises and rapidly captures market shares. During the last year(s) you have probably heard about several such new companies or offerings like e.g. Uber, Airbnb, Ant Financials, Klarna, Vipps, Oscar, Lemonade, Corezoid etc.

I don’t claim to be an expert in understanding their business models neither their success, but based on my understanding there are several common identifiers that are key for most of them:

- Their business or offering are based on a technology platform – not from a traditional business model or existing value chain.

- Focus on Behavioural Economics and big data analytics as a core engine in their business.

- Businesses leveraging Automation, Artificial Intelligence, Algorithms and Machine Learning from the very beginning.

- Cloud and Digital First (or only) strategies.

- Their product / service is typically offered as an App or native service on the internet.

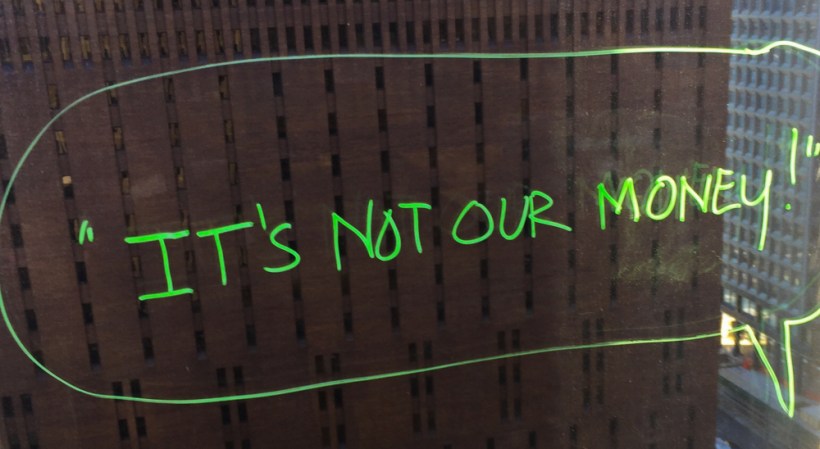

Recently a “peer to peer insurance company”, Lemonade, started selling renters and home insurance to New Yorkers. With a model different from most traditional Insurance companies they just launched their services. In their manifesto they are talking about several key points corresponding to my summary above. First off all they are focusing on the fact that the premiums are not “our money”. They have also hired one of the most famous Behavioural Economics characters in the world, Dan Ariely. Lemonade also say that they are taking a flat fee of 20% for profits and expenses. Another important part of their value proposition is the fact that each of their customers decide a cause which Lemonade will pay out an amount of money to (instead of keeping it as a profit). Lemonade quote “Job #1 is to make sure your claim is paid, job #2 is to Giveback what’s left”.

What do the incumbent Insurance companies think versus disruption?

A few weeks ago I came across a great post @ Linkedin from an innovation officer in a Nordic Insurance company saying:

Question. Is the insurance industry sailing with eyes wide open towards its Titanic moment? Participating in the future of general insurance conference in London the short answer is yes. The phrases I hear goes like this, “Our industry is ripe for disruption”, “We are at a tipping point” etc. So what’s the answer to this? All I basically hear is the echo of silence. Nobody inside the industry seems to know what to do. And then along comes Lemonade and what’s the most widespread reaction from the incumbents? “Yeah, but is it really P2P?”, “Are they actually doing something new?”. Referring to Plato’s cave and the sun story, my answer to this is; “Get out of your cave incumbents”

I do find the Titanic metaphor from the above post to be very relevant. Inertia is very dangerous – but since most of the traditional companies are very satisfied with their Titanic ships they become blind when faced with disruption.

Looking at Quora I found several interesting articles about Lemonade. If you think this is interesting I suggest to have a look here.

In summary this article is about digital disruption, inertia and the Titanic metaphor in combination to the “Plato analogy of the cave” is a clear call to action for the incumbents.

More articles to come soon! Wish you all a great day and hope this article can nourish and inspire to change and disruption.

December 5th 2016 // Göran Karlsson

Disclaimer:

When I started writing this blog more than two years ago it was influenced by the quote from the CEO of the German Media Company, Axel Springer, Mr Mathias Döphner saying: “Google is the world’s most powerful bank but dealing only with Behavioural Currency”. Today, in 2016, my professional day job has changed from working with executives in the media companies to focus more on Financial Services companies. My assumption is that Behavioural Economics is as important for a Financial Services company as for any other company.